Top 4 First Time Home Buyer Mistakes to Avoid

If you keep these top 4 first time home buyer mistakes to avoid in mind when you search for your first home, you are off to a good start. Buying your first home is a unique time in your life. It’s thrilling because it’s a huge step but it’s also terrifying because it’s such a big step with huge financial responsibilities! It’s stressful whether this is your first time buying a house or third time buying a home, but first time home buyers need to separate emotion from their purchasing decision which is tricky sometimes. In addition to that challenge, access to real estate search engines at your fingertips, it’s easy for a first time home buyer to get overwhelmed by all of the options out there. It is difficult to keep your emotions in check and make sure that you’re buying a condo that suits your needs now and in the future.

Think big picture

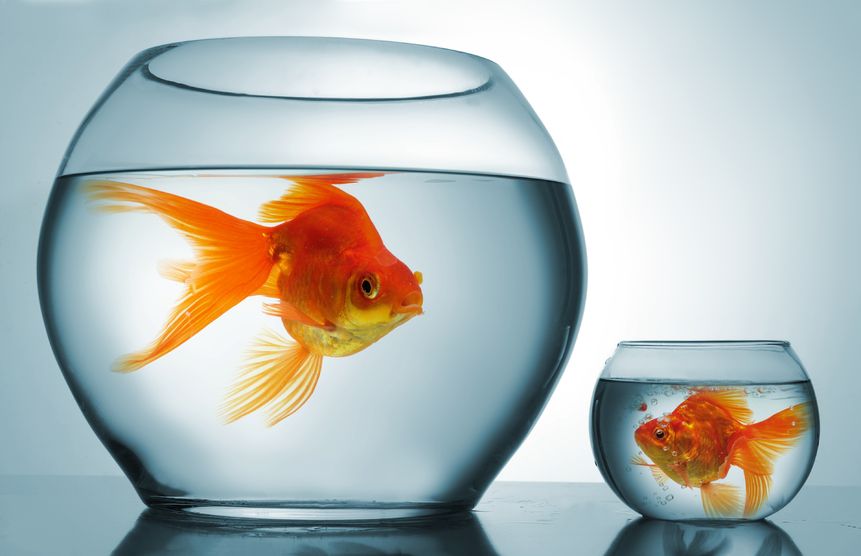

If you recently got married, or are single buying your first home it might be tempting to check out a cute little one bedroom home. It’s only one or two of you, why buy a large two to three bedroom condo unit? It might be wise to check out a bigger home because it might not always be just you, or the two of you living in that home. If you don’t consider the big picture, you might find yourself as a home buyer again a few years down the road if you decide to expand your family. Having children or plans for parents moving in at a certain age are things that need to be taken into consideration when buying a home. A two or three bedroom home is a reasonable sized place to look if you are considering any of these family changes in the next couple years. Thinking about the big picture will save you the hassle of trying to sell your home at the same time as look for a new home because you outgrew the home you had just bought not too long ago.

Too Much Space

A newlywed who has their whole future with their spouse ahead of them might get caught up in future planning and buy a home that would accommodate them and their five future children they are planning on having. While it is great to plan ahead, as we discussed in the previous section, you do not want to get yourself into too big of a home for your current needs. Typically a really big home comes with a really big mortgage payment. Life happens, so if you don’t have the five children you were planning on or there is a cut-back at work, you don’t want to find yourself in a monster house you don’t need. If you plan on having a big family, buy a larger home but be realistic. You don’t want to carry a large mortgage for years when you don’t need to, and deal with the enormous amount of maintenance involved in a house that size. This is one of the first time buyer mistakes where the buyer wants to be prepared, but may be a little too eager.

Location, Location, Location…..

I’m sure you’ve heard it before, it’s all about location location location. However, when you fall in love with a home, it’s one of the easiest first time buyer mistakes to make because emotion can over rule logic. You want to make sure you are investing your money wisely in a property that you will be able to sell in the future if you choose to do so. Take a look at the village you are buying and the surroundings. Maybe the price of the unit you’re looking at buying is so low because it is sandwiched between the main road and the parking lot for the village so it’s noisy. It is best to keep the location in mind when buying a home because you never know what the future might bring and you want to make sure your property is desirable for potential buyers.

Thinking of Your Home as a Business

There are plenty of shows on television that talk about home flipping. If you go into buying a property with that idea in mind, do yourself a favor and make sure that you have done your research on the home and the current market. So many times first time home buyers purchase a home, make renovations that they feel would increase the home’s value to get a profit, and find out that they lost money. This could be due to a number of reasons. One possibility is the renovations being done on the property are to the owner’s taste and preference instead of neutral for the buyer’s taste. Investing in the wrong places and unnecessary renovations are also common first time buyer mistakes when trying to flip a house. If you plan on purchasing to flip, take your time, consult professionals and really think through your decision. Flipping a home for profit is not as easy as it looks on television. Another option is turning your home into a rental property. It is important to know what to expect from the unit you purchase before you buy. Leighton Realty has an investment page where you can see how much different types of units charge as yearly or seasonal rentals at Ocean Edge in Brewster.

How do I avoid making these first time buyer mistakes?

Buying your first home is exciting and stressful. It is important that you are prepared and feel completely confident in your purchase. If you are interested in buying your first home, contact Michael Leighton and his team at Leighton Realty. Their testimonials from past and current clients support their position as the #1 Sales Agent for Ocean Edge (since 2004) and the #1 Agent for the town of Brewster (since 2007). Michael and his team will guide you through the home buying process so you do not leave wondering whether you made one of these 4 first time home buyer mistakes.